Record High Investment Loans

What Record High Investment Loans Mean for Australia’s Housing Market

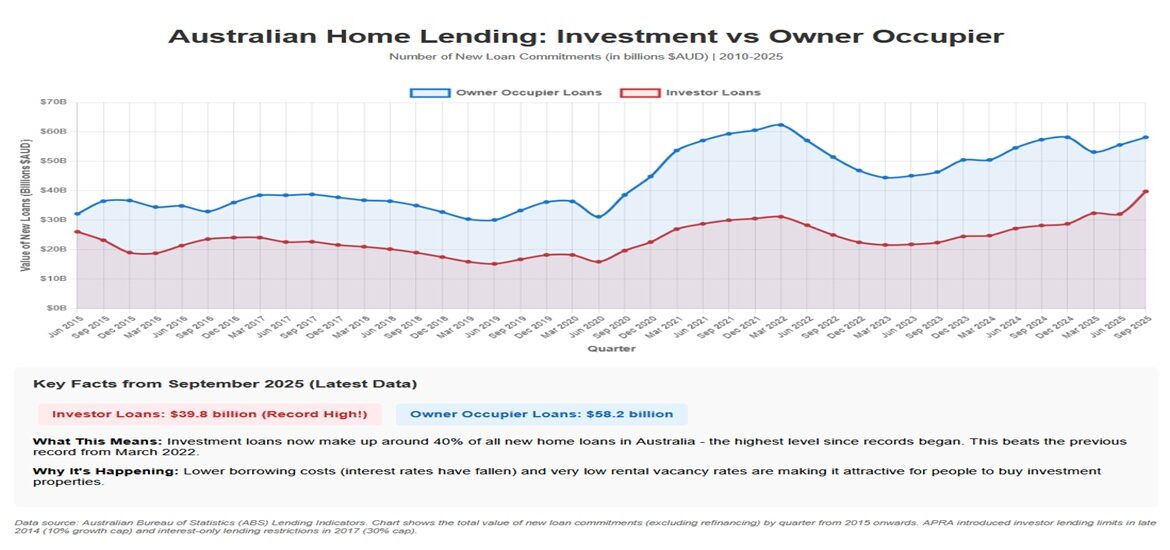

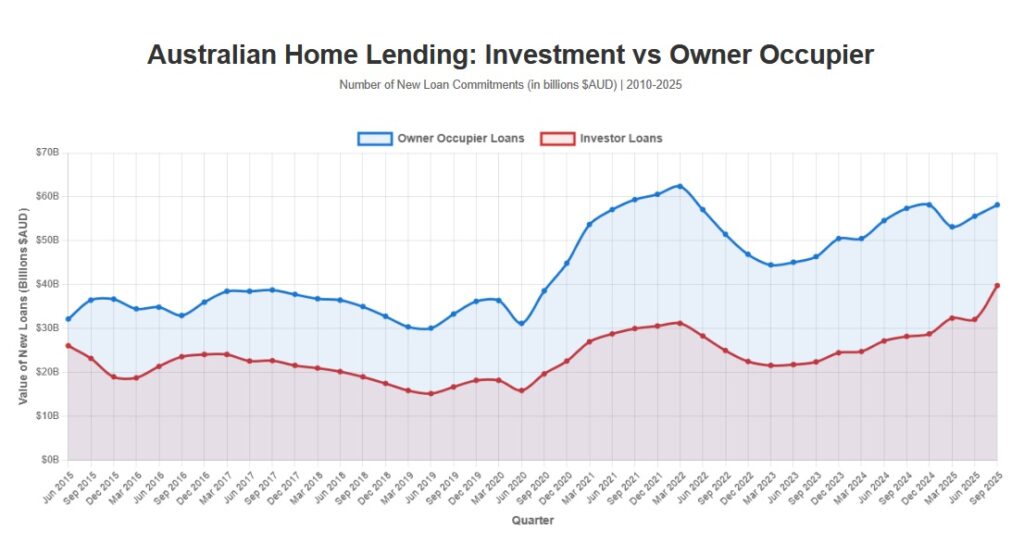

Australian investment loans have reached their highest level ever, making up 40% of all new home lending. But with APRA watching closely and rental supply still very tight, could new restrictions be coming? Here’s what the latest data tells us.

The Big Picture: Investment Loans Break All Records

The latest numbers from the Australian Bureau of Statistics have sent shockwaves through the property market. In September 2025, investment loans hit a record high of $39.8 billion – the highest level since records began. This beats the previous record from March 2022, when investment lending reached $31.2 billion.

To put this in simple terms, for every $100 in new home loans being written in Australia right now, about $40 is going to property investors rather than people buying homes to live in themselves. Owner occupier loans are sitting at $58.2 billion, which is also quite high, but it’s the investment lending surge that has everyone talking.

Looking Back: The Journey Since 2015

The story of investment lending in Australia is like a roller coaster ride with some very big ups and downs. Back in mid-2015, investment loans were worth around $26 billion per quarter. But then something important happened – APRA stepped in.

When APRA First Got Involved

In late 2014, Australia’s banking watchdog (APRA) became worried about how fast investment loans were growing. They put in place a rule that said banks could only grow their investment lending by 10% each year. This was because house prices were going up very quickly, and APRA was concerned that too many people were borrowing money to buy investment properties.

The effect was almost immediate. Investment lending dropped from $26.1 billion in June 2015 down to just $15.2 billion by June 2019 – nearly cut in half! The rules worked exactly as APRA wanted them to.

The COVID Effect and the Big Comeback

When COVID-19 hit in 2020, all types of lending dropped dramatically as uncertainty gripped the market. Investment loans fell to just $15.9 billion in June 2020. But then something interesting happened – as interest rates dropped to record lows and government support kicked in, lending came roaring back.

From mid-2020 to early 2022, both owner occupier and investment lending grew strongly. Investment loans climbed back up to around $31 billion by March 2022. Then, when the Reserve Bank started raising interest rates aggressively in 2022 and 2023 to fight inflation, lending cooled off again. Investment loans dropped back to around $21-22 billion through much of 2023.

But now, in 2025, we’re seeing something that’s never happened before. Investment loans have shot up to $39.8 billion – smashing all previous records.

Why Are Investment Loans So High Right Now?

There are several reasons why so many people are choosing to buy investment properties right now:

Lower Interest Rates Are Back

After the Reserve Bank raised interest rates sharply in 2022 and 2023, they’ve started cutting rates again in 2025. This makes borrowing cheaper and more attractive for investors. When the cost of borrowing goes down, the returns from renting out a property look much better.

Rental Vacancy Rates Are Extremely Low

Here’s a really important fact: rental vacancy rates across Australia are sitting at record lows. The national vacancy rate is just 1.2% as of September 2025. In some cities like Perth (0.7%), Adelaide (0.5%), and Hobart (0.8%), it’s almost impossible to find a rental property.

What does a 1.2% vacancy rate mean? It means that out of every 100 rental properties in Australia, only about one is sitting empty. That’s incredibly tight. A healthy rental market usually has a vacancy rate of around 2.5-3%, which gives renters some choice and keeps rent growth under control.

With such low vacancy rates, landlords can charge higher rents and are almost guaranteed to have tenants. This makes investment properties look very attractive right now.

Strong Rental Demand

Australia’s population is growing, and many people need somewhere to live. The country needs to build about 75,000 apartments per year just to keep up with population growth, but we’re only building around 60,000 per year. This gap between supply and demand is pushing more investors into the market, seeing it as a good opportunity.

The Housing Supply Problem

This is where things get complicated. You might think that all these investors buying properties would help with the housing shortage – after all, more properties available to rent should help, right?

Well, yes and no. Here’s what’s actually happening:

New Construction Is Falling Behind

According to the National Housing Supply and Affordability Council, Australia built only 177,000 homes in 2024, far below the 223,000 that were needed to meet demand. Over the next five years, the country is expected to fall about 262,000 homes short of the target of building 1.2 million new homes.

When you take into account homes being knocked down and demolished, the net new supply is expected to be just 825,000 new homes by mid-2029 – way below what’s needed.

Why Aren’t We Building More?

Several things are making it hard to build enough homes:

- Building materials are expensive

- There aren’t enough construction workers

- Interest rates made borrowing more expensive for developers

- Complex planning rules slow everything down

- Many housing projects aren’t profitable at current costs

The National Housing Supply and Affordability Council says the single biggest problem is that many housing projects just don’t make financial sense anymore because land costs, financing costs, and building costs are all so high.

The Investor Impact on Supply

Here’s the tricky part: when investors buy existing properties rather than newly built ones, they’re competing with people who want to buy a home to live in (owner occupiers). This can push up house prices, making it harder for first-time buyers to get into the market.

However, those investment properties do add to the rental supply, which is desperately needed given how tight the rental market is. So it’s not all bad – it depends on whether investors are buying new properties (adding to total supply) or existing properties (just changing who owns them).

What Happens to Renters in This Market?

The rental market right now is very difficult for tenants:

Rising Rents

With vacancy rates so low, rents have been rising steadily. Nationally, combined rents are up 4.6% year-on-year. In some cities, the increases have been even higher – Perth has seen rent growth of 7.3% in the past year.

The national average weekly rent reached $653.54 in September 2025. In capital cities, it’s even higher at $747.70. For many Australian families, rent is taking up a bigger and bigger chunk of their income.

Competition for Properties

Anyone who’s tried to rent a place recently knows how tough it is. With so few properties available, there are often dozens of people applying for the same rental. Some cities like Sydney (1.4% vacancy) and Brisbane (0.9% vacancy) have particularly fierce competition.

This gives landlords a lot of power in the rental relationship. Tenants may feel they can’t ask for repairs or negotiate on rent because they’re worried about losing their home in such a tight market.

Could APRA Step In Again?

This is the big question everyone’s asking. With investment loans at record highs, will APRA bring back restrictions like they did in 2014?

The Warning Signs Are There

In July 2025, APRA Chair John Lonsdale gave a clear signal that the regulator is watching closely. He said that APRA is “preparing to intervene” if lending risks rise as interest rates fall. He specifically mentioned that historically, when interest rates drop, there tends to be “higher credit growth and leverage, higher house prices, and often more risky lending, such as high debt-to-income and investor lending.”

APRA has made it clear they’re not happy with investment lending making up such a large share of total lending. The current 40% share is very high by historical standards.

What Tools Could APRA Use?

APRA has several options if they decide to step in:

1. Bring Back Investment Lending Caps

APRA could reinstate the 10% annual growth limit on investment lending that worked so well between 2014 and 2018. This would force banks to slow down how quickly they increase investment loans.

2. Debt-to-Income Limits

APRA has been talking about putting limits on how much people can borrow compared to their income. Currently, about 10% of new loans have a debt-to-income ratio of more than six times the borrower’s income. These loans make up about 31% of the value of all new property loans. Restricting these high-ratio loans would particularly affect investors who often borrow larger amounts.

3. Tighten the Serviceability Buffer

Right now, banks have to test whether borrowers could still afford their loans if interest rates rose by 3%. APRA could increase this buffer to make it harder to borrow as much.

4. Interest-Only Lending Restrictions

APRA previously capped interest-only loans at 30% of all new lending. While interest-only lending is currently low, if it starts picking up again (as investors often prefer these loans), APRA could bring back restrictions.

The Timing Question

APRA has said they’re currently engaging with banks “on the implementation of additional macroprudential tools” to “ensure such tools can be activated in a timely manner if needed.” This suggests they’re getting ready to act but haven’t decided to do so yet.

The key question is: when will they pull the trigger? APRA will be looking at several things:

- How high investment lending goes

- Whether lending standards start slipping

- How quickly house prices rise

- Whether household debt levels become concerning

- How the broader economy is performing

What Would New Restrictions Mean?

If APRA does step in with new restrictions, here’s what could happen:

For Property Investors

New restrictions would make it harder to get investment loans approved. Banks would likely:

- Require larger deposits

- Be more careful about income and expense checks

- Limit how much they lend to investors

- Possibly charge higher interest rates on investment loans

Some investors might find they can’t borrow as much as they hoped, or might not get approved at all. This could particularly affect people trying to buy their second or third investment property.

For House Prices

History shows us what happened last time APRA restricted investment lending between 2014 and 2018. House price growth slowed down significantly, particularly in Sydney and Melbourne. In fact, prices actually fell in 2018-2019 in some markets.

If similar restrictions came in now, we’d likely see:

- Slower house price growth

- Possibly falling prices in some areas (especially if restrictions are harsh)

- Less competition at auctions

- Longer time for properties to sell

For Renters

This is where it gets complicated. On one hand, fewer investors buying properties might reduce competition for first-home buyers, which is good. On the other hand, with fewer new landlords entering the market and no improvement in new housing construction, the rental shortage could actually get worse.

This is the big worry – if investment lending restrictions reduce the number of rental properties available, but don’t increase the number of owner-occupied properties being built, renters could be left in an even tighter squeeze.

For First-Home Buyers

First-home buyers might see some benefits from investment lending restrictions:

- Less competition from investors at auctions

- Potentially lower house prices

- Better chance of getting loan approval

However, they’d still face challenges from tight lending standards and would need to save a decent deposit.

For the Broader Economy

Significant restrictions on lending can have wider effects on the economy:

- Construction activity might slow down further

- Property-related businesses could see reduced work

- Consumer confidence might be affected

- Bank profits could take a hit

The RBA and government would need to consider these broader economic impacts when deciding on any restrictions.

The Balancing Act

APRA faces a really difficult balancing act. On one hand, they need to make sure the financial system stays stable and that people aren’t borrowing too much money they can’t pay back. On the other hand, they don’t want to make the housing shortage worse or hurt the economy.

Australia’s household debt is already very high compared to other countries. Australians have one of the highest levels of household debt relative to income in the world. This makes the country vulnerable if something goes wrong economically and people can’t pay back their loans.

But at the same time, with such low rental vacancy rates and such a big shortage of homes, cutting back on investment lending could make life even harder for renters who are already struggling to find somewhere to live.

What Should People Do Now?

If you’re thinking about buying an investment property, getting a loan, or renting, here’s some practical advice:

For Investors

If you’re planning to buy an investment property, don’t assume the current easy lending conditions will last forever. Consider:

- Getting pre-approval sooner rather than later

- Making sure your finances are in good shape

- Having a bigger deposit ready

- Planning for potential changes to lending rules

- Doing thorough research on rental demand in your target area

For Renters

Unfortunately, the rental market is likely to stay tight for at least the next year or two. Consider:

- Being prepared to act quickly when you find a suitable property

- Having all your documents ready (references, pay slips, ID)

- Being realistic about what you can afford and find

- Looking at areas you might not have considered before

- Understanding your rights as a tenant

For First-Home Buyers

If you’re trying to buy your first home, this might be a challenging but potentially rewarding time:

- Save as much deposit as you can

- Get your finances in order early

- Consider getting advice from a mortgage broker

- Watch the market for signs of any APRA intervention

- Be patient and don’t rush into buying if conditions don’t feel right

The Bottom Line

Investment loans hitting a record high of $39.8 billion shows that property investing is more popular than ever in Australia. With rental vacancy rates at historic lows and interest rates falling, it’s not hard to see why investors are jumping into the market.

However, this surge in investment lending is raising red flags at APRA, which has already signalled it’s ready to step in if needed. Given that investment loans now make up 40% of all new lending – the highest share ever – and APRA has a history of intervening when things get too heated, new restrictions seem quite possible.

The big challenge for policymakers is how to cool down excessive borrowing without making the housing shortage worse. Australia desperately needs more homes – both for sale and for rent. Restrictions on investment lending might help make houses more affordable for first-home buyers, but could also reduce the supply of rental properties at a time when renters are already struggling.

Whatever happens next, one thing is clear: the Australian property market is at a critical point. The decisions made by APRA, the Reserve Bank, and government in the coming months will shape housing affordability and availability for years to come.

For now, anyone involved in the property market – whether as an investor, first-home buyer, renter, or homeowner – should keep a close eye on APRA’s announcements and be prepared for potential changes to lending rules. The record-breaking investment lending numbers of September 2025 may well be looked back on as the peak before another period of regulatory intervention.

Data source: Australian Bureau of Statistics (ABS) Lending Indicators, September 2025. Additional sources: National Housing Supply and Affordability Council, APRA announcements, SQM Research rental vacancy data.